boise idaho sales tax rate 2019

This is how your levy rate is determined. You can pay tax when.

Did You Pay Idaho Use Tax Probably Not Stateimpact Idaho

Voter Approved fund tracker 2020 INFORMATION AND DATES TO REMEMBER The next tax deed sale will be September 2023.

. The 6 sales tax rate in Banks consists of 6 Idaho state sales tax. Wayfair Inc affect Idaho. 31 rows Ammon ID Sales Tax Rate.

You bought any untaxed fuel and used it for a taxable purpose. Form 40 is the Idaho income tax return for Idaho residents. The average yearly property tax paid by Boise County residents amounts to about 189 of their.

The sales tax jurisdiction name is Boise which may refer to a local government division. Idaho residents must file if their gross income for 2021 is at least. Fast Easy Tax Solutions.

The 95 sales tax rate in Boise City consists of 45 Oklahoma state sales tax 2 Cimarron County sales tax and 3 Boise City tax. Thats compared to 68 in 2019. Idaho County-Level Sales Taxes.

Youre a Qualified Consumer. Single age 65 or older. There is no applicable county tax city tax or special tax.

Pursuant to Idaho Code 63-1005 we will start the tax deed process in August 2021 with a letter advising owners that they have until January 31 st 2022 to pay. Married filing separately any age. Blackfoot ID Sales Tax Rate.

While taxing districts set their levy rate. Does Idaho have local sales tax. Ad Find Out Sales Tax Rates For Free.

The Tax Reporting Department will remit and report the sales tax collected to the State of Idaho and all other states as necessary. You owe fuels tax because you used dyed diesel on a taxable road. Income tax rates range from 1 to 65 on Idaho taxable income.

4 rows The current total local sales tax rate in Boise ID is 6000. Did South Dakota v. 15 lower than the maximum sales tax in OK.

The current sales tax rate in Idaho is 6. Boise Auditorium District 5 On hotelmotel occupants in the Boise metropolitan. The Idaho sales tax rate is currently 6.

See Motor Fuels Tax Rule 135 IDAPA 350105. You pay less for utilities and car insurance too. The progressive income tax tops out at 74 while the sales tax is about 6.

Individual income tax is graduated. There is no applicable county tax city tax or special tax. Rising Tax Rates.

For tax rates in other cities see Oklahoma sales taxes by city and county. This is the total of state county and city sales tax rates. Tax rates Tax Rate Notes Beer 15 centsgallon Beer over 4 alcohol content strong beer is taxed as wine.

In Ada County property taxes will account for 47 of the countys 2019 budget a budget that has seen a 27 increase in the last 4 years alone. Instructions are in a separate file. Idaho has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 3.

A levy rate of 014 rounded to three decimals means you owe 14 of taxes for every 1000 of your propertys taxable value. Eagle Star and Kuna residents will cover 89 or. Average Sales Tax With Local.

The last time Boises residential and commercial property tax burden was evenly split was 2001 when commercial properties were responsible for 51 of the tax base and residential covered 49. There is no applicable special tax. You can print a 6 sales tax table here.

For tax rates in other cities see Idaho sales taxes by city and county. Heres a list of the taxes the state collects. Please check with Tax Reporting in advance if you are making out of state sales.

Fuel in Idaho can use this form to pay the Idaho fuels use tax or sales use tax. Boise County Idaho Property Taxes - 2022. The Boise sales tax rate is 0.

Single under age 65. Property 7 days ago The median property tax in Boise County Idaho is 1044 per year for a home worth the median value of 186700. The minimum combined 2022 sales tax rate for Boise Idaho is 6.

IDAHO TAXES Most of Idahos tax revenues come from income tax salesuse tax and property tax. Form ID-POA Power of Attorney 12-17-2019 Form ST-101 Sales Tax Resale or Exemption Certificate 07-13-2020 Form STC-06 Request for Copies of Idaho Tax Returns 08-31-2020 Idaho Taxpayer Rights 08-27-2019. You can print a 6 sales tax table here.

Levy Rates Voter Approved Fund Tracker 2021. We are continually reviewing sales tax reporting requirements for all states. Boise residents are shouldering less of that burden than most other Ada County cities.

For investors the average 1 property tax rate is a bargain especially when you factor in the low cost of housing. In the 2018 tax-year the property taxes collected across Idaho increased by 64 marking the highest increase in taxes paid in a decade. Boise has very low taxes especially compared to the West Coast.

Idaho has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 3. Boise County collects on average 056 of a propertys assessed fair market value as property tax. The bill would partially offset the cost of the ongoing cuts to the state treasury by permanently tapping 94 million a year from the Tax Relief Fund a state fund that now collects all sales taxes paid on online purchases rather than sending those taxes through the same distribution formula to local governments and the state general fund as other sales taxes.

This means that Idaho taxes higher earnings at a higher rate. There are a total of 124 local tax jurisdictions across the state collecting an average local tax of 0044. You can print a 95 sales tax table here.

The sales tax jurisdiction name is Boise Auditorium District Sp which may refer to a local government division. The 6 sales tax rate in Boise consists of 6 Idaho state sales tax. The County sales tax rate is 0.

For tax rates in other cities see Idaho sales taxes by city and county. Levy rates for 2019 in Boise were at their lowest levels in at least 10 years.

Idaho Residents Start Seeing Tax Relief Money

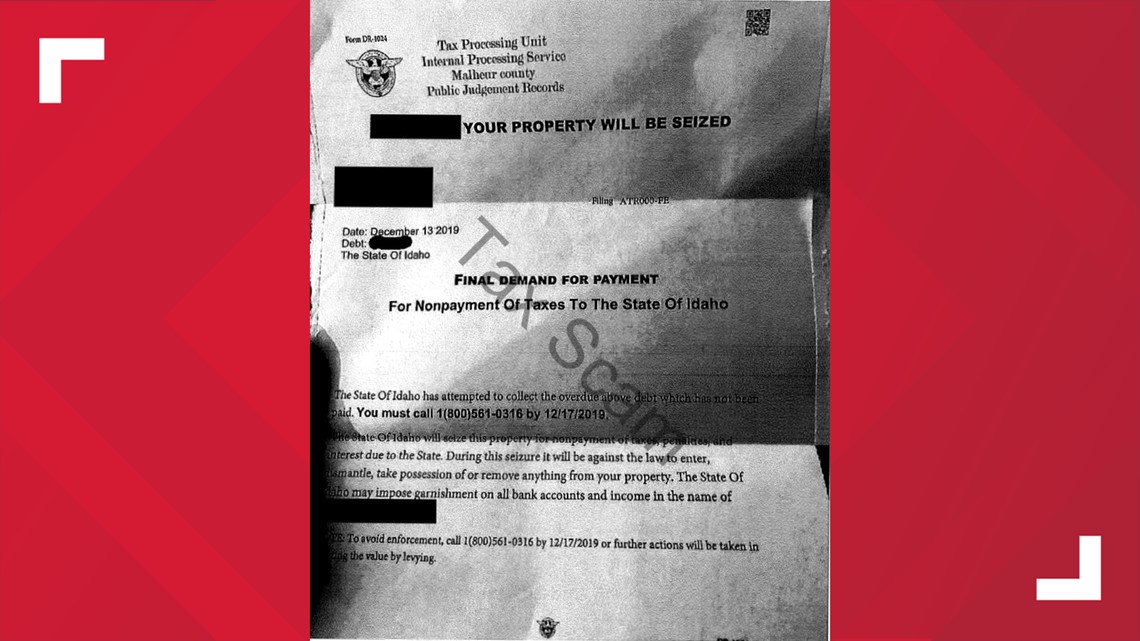

Idaho Tax Commission Renews Warning About Fraudulent Mailings Ktvb Com

Idaho Tax Commissioners Delay Income Tax Filing Deadline Boise State Public Radio

Some Idaho Residents To See One Time Tax Rebate This Summer East Idaho News

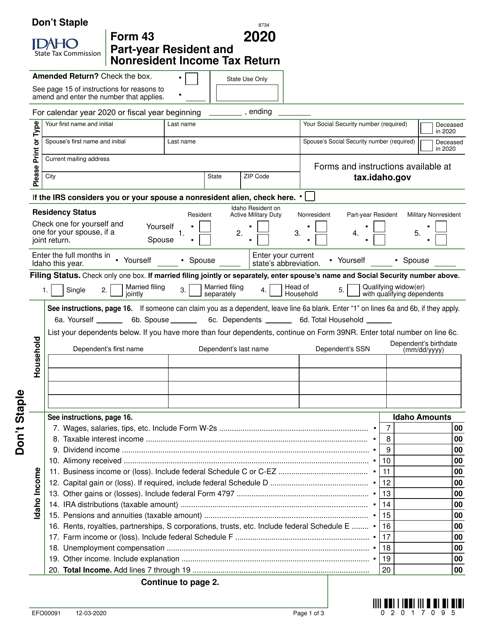

Form 43 Efo00091 Download Fillable Pdf Or Fill Online Part Year Resident And Nonresident Income Tax Return 2020 Idaho Templateroller

Idaho S Grocery Sales Tax Is An Issue At Every Legislative Session Have Thoughts Let S Talk Idaho Capital Sun

Idaho State Income Tax Refund Status Id State Tax Brackets

Sweeping Property Sales Tax Proposal Dead For 2022 Session

Idaho House Passes 600 Million Income Tax Cut And Tax Rebate Bill Idaho Capital Sun

State Income Tax Rates Highest Lowest 2021 Changes

Idaho Property Taxes Everything You Need To Know

Claim Your Grocery Credit Refund Even If You Don T Earn Enough To File Income Taxes Idaho Bigcountrynewsconnection Com

Idaho Sales Tax Guide And Calculator 2022 Taxjar

30 Things People From Boise Have To Explain To Out Of Towners Meridian Idaho Vacation Trips Moving To Idaho

Total Sales Tax Per Dollar By City Oklahoma Watch

Explain This To Me How Idea To Cut Most Homeowner Property Tax And Increase Sales Tax Would Work